New Crypto Hub in the Making?

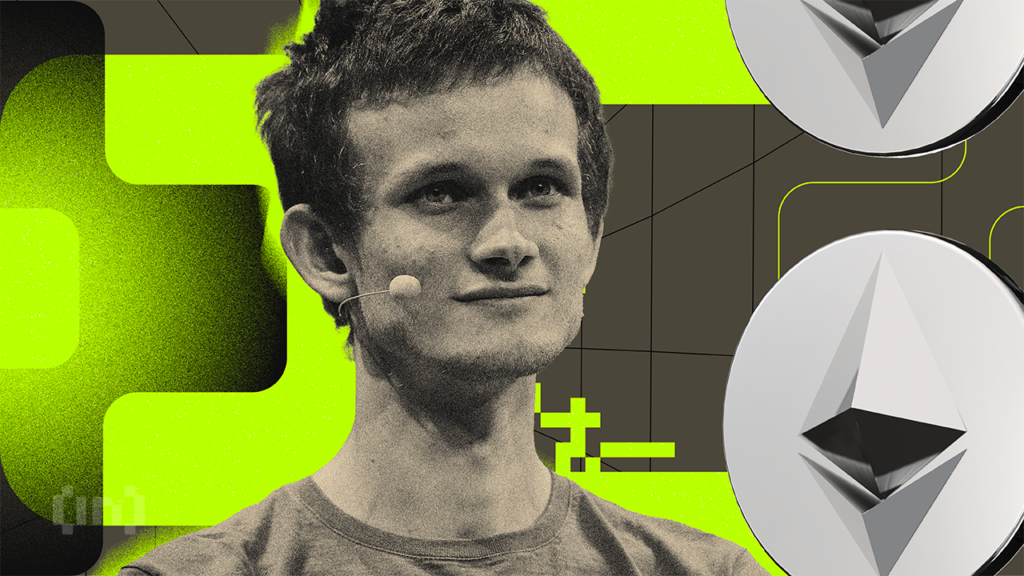

Ethereum inventor Vitalik Buterin has received an “Employment Gold Card” from Taiwan as the country ramps up efforts to put its nascent crypto sector on the map.

The Employment Gold Card is a special visa program designed to attract foreign talent to the country. It will allow Buterin to reside in Taiwan for up to three years and work without any restrictions.

Vitalik Buterin Backs Taiwan’s Blockchain Sector

Buterin has been a vocal supporter of Taiwan and its blockchain industry and has visited the country on multiple occasions.

Last year, he even appeared on the Innovative Minds podcast with Taiwan’s Minister for Digital Development, Audrey Tang. They discussed blockchain technology and its role in global politics and the world economy during the show.

They also talked about Buterin’s views on identification technologies like Worldcoin.

Tang presented Buterin with his Employment Card at a ceremony this week during the Plurality Taipei conference. The event brought together a diverse group of technologists to discuss digital democracy and the challenges presented by online discourse.

According to local media, Buterin said that Taiwan has a thriving Ethereum community. He added that the Gold Card will allow him to visit and work there more easily in the future.

Taiwan Prepares for Hong Kong-Style Crypto Regulations

Courting crypto leaders like Vitalik Buterin is one way Taiwan’s government supports the country’s emerging blockchain sector. Like others around the world, it has also moved to regulate the space and establish a clear rulebook for crypto firms.

Initially announced in March, Taiwan’s anticipated regulatory framework will give the Financial Supervisory Commission (FSC) responsibility for overseeing the country’s crypto sector.

In a document seen by the Taiwanese news outlet ABMedia, the FSC outlined 13 principles that will guide its approach to crypto regulation.

The new guidelines would require cryptocurrency exchanges to register with the FSC and comply with anti-money laundering (AML) regulations.

They also propose consumer protection measures. For example, the FSC suggests mandating certain hot and cold wallet ratios for customer deposits with crypto exchanges. It also recommends requiring them to insure against user losses.

Significantly, the proposed guidelines look to Hong Kong as a model for Taiwan’s crypto regulation. Although the FSC referred to other regulatory regimes around the world, it paid special attention to Hong Kong’s Virtual Asset Service Provider (VASP) licensing framework.

Other ideas discussed in the document include a ban on stablecoins pegged to the Taiwanese dollar and restrictions on foreign exchange advertising in the country.

Finally, the FSC expressed an interest in fostering self-regulation through the establishment of new industry associations. To that end, Taiwan’s Ministry of Economic Affairs has drafted an amendment to existing legislation governing such associations. The latest amendment will create a specific category for digital asset services.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.