Should Investors Buy Low-Cap Altcoins in Q3/2025?

Crypto investors are well aware of the risks involved in low-cap altcoins. However, this segment often delivers impressive returns, sometimes multiplying investments several times over.

So, should investors start buying low-cap altcoins in July, especially now that experts believe altcoin season has begun?

Opportunities and Risks for Low-Cap Altcoins in Q3 2025

Although the total market cap reached a new high in July, capital flows mainly into Bitcoin and major altcoins.

TradingView data supports this. While the total crypto market cap nears $4 trillion, the market cap excluding the top 100 altcoins stands at just $15.4 billion.

CoinMarketCap data shows that the top 100 altcoins each have a market cap above $700 million. Altcoins outside this group—those below $700 million—are categorized as mid-cap or low-cap.

This capital disparity suggests that investors remain cautious. They prefer altcoins with high liquidity or those that institutional players and listed companies notice.

However, another interpretation offers hope. Some analysts believe the current capital inflow is still in its early phase.

Many analysts share the same view as investor Mister Crypto. According to them, the market is still in phase two. In this stage, investors mostly favor Ethereum. Capital will eventually rotate to large, mid, and low caps.

This delay creates a window of opportunity for many investors to buy early and at a good price. It’s also a chance to get ahead of the broader capital flow.

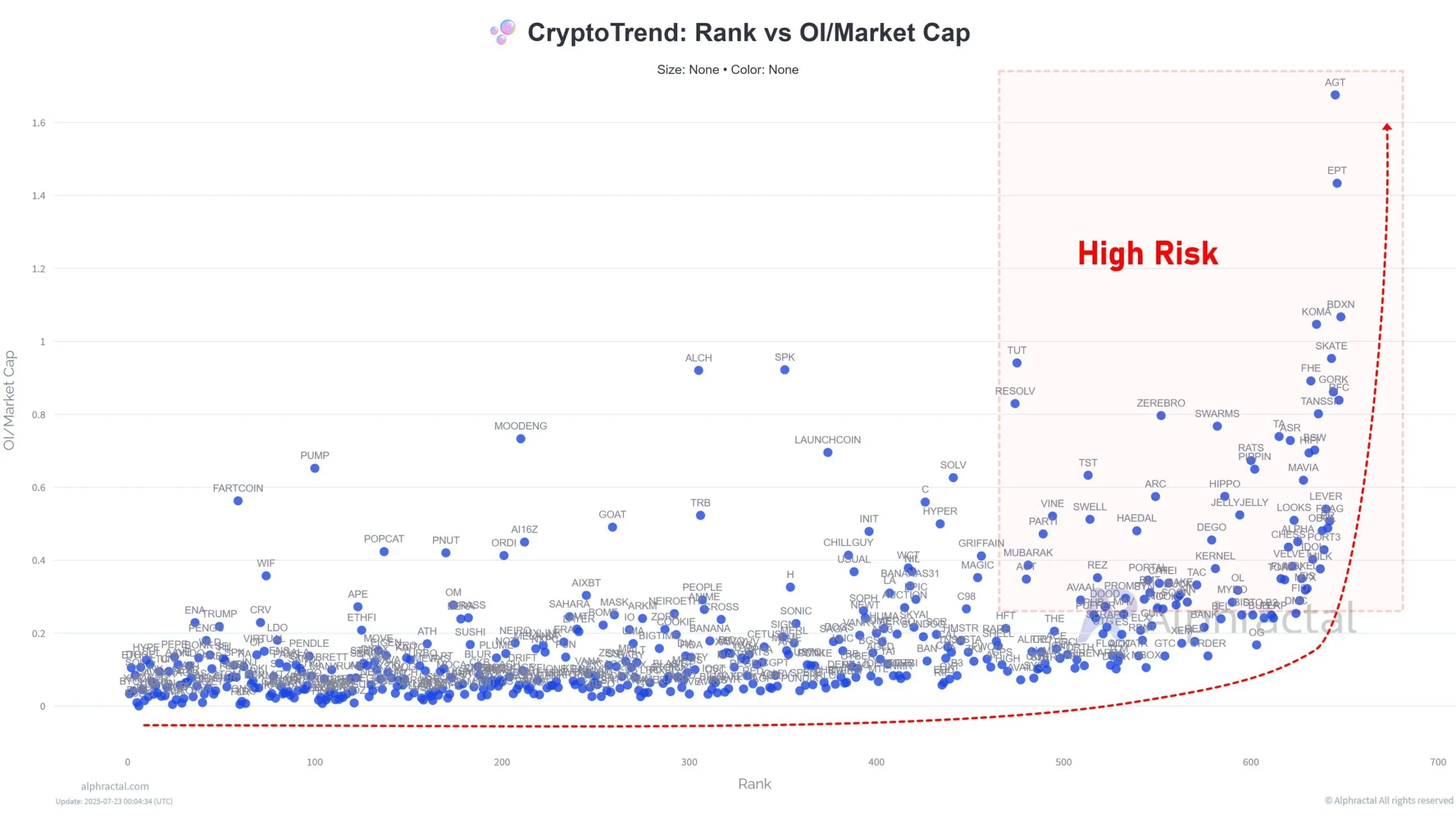

Still, analysts like João Wedson remain skeptical of ultra-low-cap altcoins—especially those outside the top 300. These coins usually have a market cap of less than $200 million. He cites the Open Interest to Market Cap Ratio as a warning signal for these coins.

Data shows that open interest for coins outside the top 300 is unusually high compared to their market caps.

When open interest significantly surpasses market capitalization, it indicates that traders are focusing on short-term movements in the derivatives market instead of actively trading the tokens in spot markets. Consequently, these altcoins experience low liquidity and encounter extreme volatility.

“From the Top 300 down, Open Interest becomes disproportionately high compared to Market Cap — a strong risk signal. What does this mean? These altcoins will eventually liquidate 90% of traders, whether they’re long or short. They are also much harder to analyze with consistency,” Joao Wedson explained.

On X, excitement about altcoin season is spreading fast in July. However, whether investors should buy low-cap altcoins in Q3/2025 still depends heavily on their personal risk appetite and investment strategy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.